“OK, Boomer.”

That snarky Gen Z/Millenial comeback to the shade thrown at them by older people means “you are clueless about what’s hip and relevant.” I am pretty sure no Baby Boomer has actually been offended by this, as they are anything but clueless or irrelevant, but the news media has of course made a big deal out of it.

And anyway, Boomers have the right to throw some weight around as they have an outsized impact on our economy — and will play an even larger role in the coming years.

Here’s why:

Experts predict they are about to sell or transfer about 10 TRILLION DOLLARS worth of assets over the next two decades as, depending on who’s figures you trust, up to 70-80 percent of the estimated 12-15 million+ businesses they own change hands.

This is what is known as the “retirement tsunami” or “silver tsunami.” While it might not reach the epic proportions some analysts have predicted, surely there will be a LOT more businesses in transition as their Boomer owners age out over the next 20 years.

In other words, you can likely expect a prolonged buyer’s market due to the glut of offerings. So, if you plan on selling your business within the next few years, you need to do some work in order to get the highest valuation possible, because you will be competing with a lot of OTHER Boomers trying to exit.

Here is what we have been working on with a few of our customers, and recommend to anyone seeking an exit:

- Get a valuation done. Either a consultant in the field or a business broker can help figure out what the business is really worth.

- Figure out how you, as a leader, will transfer power so that the business can go on without you. If your business has survived mostly based on your personality, you need to establish a management structure which allows new leaders to successfully take over.

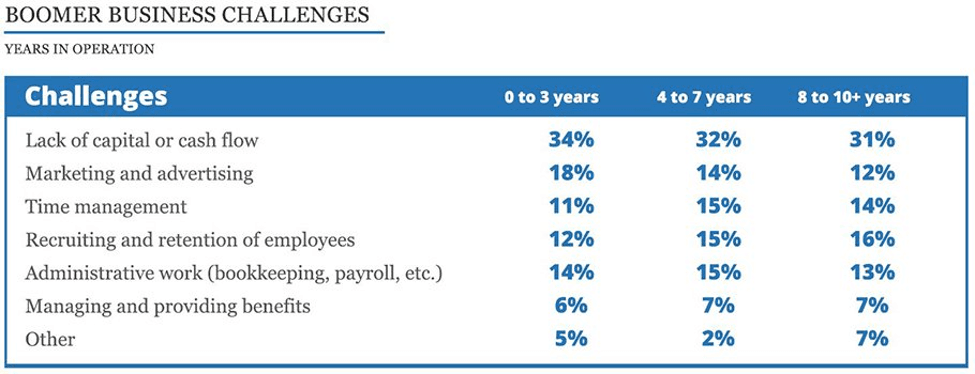

- Create a documented revenue process so that the wheels keep turning once you are no longer at the helm anymore. Even if you change your mind and decide to stay, creating a solid revenue process will create more value in your enterprise and alleviate the number one business challenge boomers face: LACK OF CAPITAL OR CASH FLOW.

SOURCE: https://www.guidantfinancial.com/small-business-trends/baby-boomer-business-trends/

When should you start working on the above? I recommend a MINIMUM of 3 years before your planned exit, so you have enough time to achieve the best transaction possible. 5 to 10 years is MUCH better.

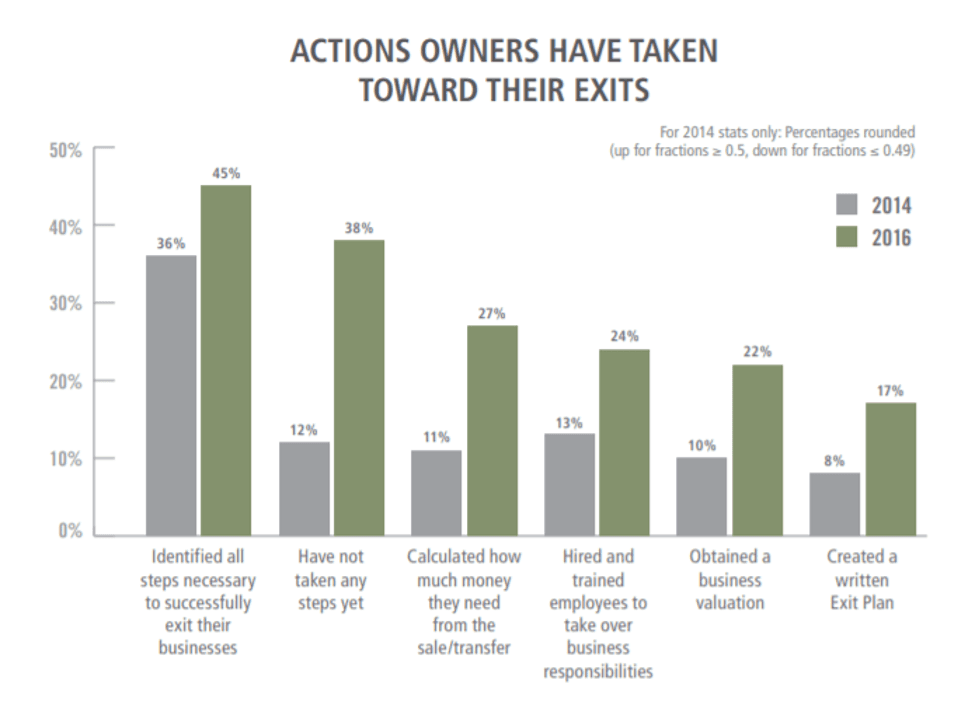

Now, if you are the typical Boomer, I know that you haven’t done any of the above, lol. And I’ve got the data to prove it. Just look at this chart from BEI’s 2016 survey of business owners:

As you can see, while things improved in the later year when compared with the earlier survey, business owners are still very unprepared to exit successfully. 78 percent lack the first step, a valuation. And only 17 percent had a written plan. For the upcoming buyer’s market, this shows that a lot of business owners will be caught flat-footed and their companies could be harmed due to bad transitions.

Apart from the financial risks of not planning properly, consider also the human costs: it’s not only the owners who will be affected – its also the spouses and kids. A 60 person company actually serves about 150 people, I’d say. It goes beyond an owner not having enough for retirement – the survival of a lot of people could be at stake as well.

Volohaus is grateful to be able to help business leaders transition out of their companies while leaving them in great shape for years to come. It requires a science-based approach that is scalable and repeatable no matter who is in charge. I like to call it building a Revenue Machine.

The trick is to plan early – way earlier than you might think.

So if you are thinking about an exit, even many years away, maybe we should have a quick chat to ensure the bases are covered and it can be as successful as possible. Okay, Boomer? : )

Shaun@volohaus.com or my cell 760.815.4464

Leave a Reply