Net Promoter Score explained in depth.

Why the Net Promoter Score?

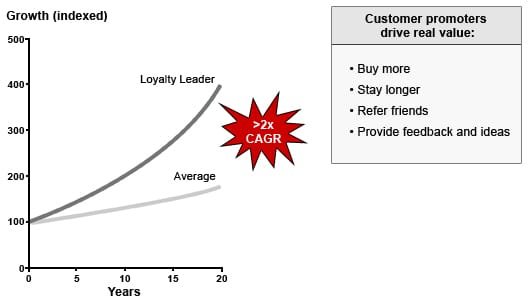

Asking the ultimate question allows companies to track promoters and detractors, producing a clear measure of an organization’s performance through its customers’ eyes, its Net Promoter Score. Bain analysis shows that sustained value creators—companies that achieve long-term profitable growth—have Net Promoter Scores (NPS) two times higher than the average company. And Net Promoter System℠ leaders on average grow at more than twice the rate of competitors.

Net Promoter System℠ is based on the fundamental perspective that every company’s customers can be divided into three categories. “Promoters” are loyal enthusiasts who keep buying from a company and urge their friends to do the same. “Passives” are satisfied but unenthusiastic customers who can be easily wooed by the competition. And “detractors” are unhappy customers trapped in a bad relationship. Customers can be categorized based on their answer to the ultimate question.

The best way to gauge the efficiency of a company’s growth engine is to take the percentage of customers who are promoters and subtract the percentage who are detractors. This equation is how we calculate a Net Promoter Score for a company:

More than a score

The score is at the heart of a Net Promoter System℠, but you can’t take action if you don’t know why a customer is or is not “likely to recommend.” You should always follow up the Ultimate Question with an open-ended question: “Why?”

The answers can help transform your organization. To learn how, check out the Closed loop, Learning and Action processes of the Net Promoter System.

While easy to grasp, NPS metric represents a radical change in the way companies manage customer relationships and organize for growth. Rather than relying on notoriously ineffective customer satisfaction surveys, companies can use NPS to measure customer relationships as rigorously as they now measure profits. What’s more, NPS finally enables CEOs to hold employees accountable for treating customers right. It clarifies the link between the quality of a company’s customer relationships and its growth prospects.

How do companies stack up on this measurement? The average firm sputters along at an NPS efficiency of only 5 percent to 10 percent. In other words, promoters barely outnumber detractors. Many firms—and some entire industries—have negative Net Promoter Scores, which means that they are creating more detractors than promoters day in and day out. These abysmal Net Promoter Scores explain why so many companies can’t deliver profitable, sustainable growth, no matter how aggressively they spend to acquire new business. Companies with the most efficient growth engines—companies such as Amazon, Rackspace, TD Bank, Harley-Davidson, Charles Schwab, Zappos, Costco, Vanguard, and Dell—operate at NPS efficiency ratings of 50 percent to 80 percent. So even they have room for improvement.

In concept, it’s just that simple. But obviously, a lot of hard work is needed to both ask the question in a manner that provides reliable, timely, and actionable data—and, of course, to learn how to improve your Net Promoter Score.

History of the Net Promoter Score

All companies seek to grow. And growth—profitable, sustainable organic growth—occurs most often when customers and employees love doing business with a company and sing its praises to neighbors, friends and colleagues.

Most leaders want customers to be happy; the challenge is how to know what customers are feeling and how to establish accountability for the customer experience.

Conventional customer-satisfaction surveys often don’t work for this purpose, because the results don’t make it back to the front line in a timely and individualized manner to actually drive behavior change.

Some years ago, Fred Reichheld and a Bain team launched a research project to determine whether a different approach would prove more fruitful. Working with data supplied by Satmetrix, they tested a variety of questions to see how well the answers correlated with customer behavior.

As it turned out, one question worked best for most mature, competitive industries:

What is the likelihood that you would recommend Company X to a friend or colleague?

High scores on this question correlated strongly with repurchases, referrals and other actions that contribute to a company’s growth. In 11 of the 14 industry case studies that the team compiled, no other question was as powerful in predicting behavior. In two of the remaining three cases, other questions won out, but the likelihood-to-recommend question was so close to the top that it could serve as a proxy for the leaders.

The likelihood-to-recommend question, of course, is the “Ultimate Question” of the book’s title. The answers to it are the basis for calculating a company’s Net Promoter score. (You can read more about the research that led to the “Ultimate Question” in Chapter Two of The Ultimate Question 2.0).

To test the link between Net Promoter scores and growth, research teams compiled scores for leading companies in a wide range of industries. What they found was compelling. Though the scores themselves varied widely by industry, Net Promoter leaders on average grew at more than twice the rate of competitors.

Benefits of NPS

Over the years, companies have developed many different methods for gauging the attitudes and behaviors of their customers. None of these methods is perfect; all are simply attempts to gather data that a company can use to improve its products and processes.

We believe that Net Promoter, as both a specific metric and a full Net Promoter System℠ is the most useful and practical method. Among its primary advantages:

- Simplicity. Net Promoter surveys typically require just two or three questions, keeping the burden on the customer low. Moreover, the key “likelihood to recommend” question is scored on a simple zero-to-ten scale. There are no complex indices or correlation coefficients. The Net Promoter score is a single number that can be tracked from week to week and month to month, just like net profit. As with net profit, of course, a company’s Net Promoter scores can be broken down however you wish—by business line, by store, by product, even by individual customer-service rep.

- Ease of use. A company can conduct its NPS® surveys by phone, e-mail or Web—whichever generates the best response rates and the most useful data. It can compile and post scores quickly, so that people can see the results of their performance in a timely fashion. It can share up-to-the-minute verbatim comments with employees and managers.

- Quick follow-up. NPS practitioners typically share customer feedback very quickly after it is received. They quickly ask managers or frontline employees to contact every customer who gives an unfavorable score (a detractor), to identify the customer’s concerns, and to fix the problem whenever possible. Frontline managers and senior leaders use NPS data and customer comments to inform decisions about process changes, new products and other innovations.

- A growing body of experience. Thousands of companies in many different industries have begun to measure their Net Promoter scores over the past several years. More important, a growing number of companies have adopted the full Net Promoter SystemSM. Among the early adopters are corporate trailblazers such as Apple, Enterprise Rent-A-Car, and Philips. These companies have developed successful systems based on Net Promoter principles but adapted to their own business. Many practitioners share their experiences and lessons learned through mechanisms such as the NPS Loyalty Forum.

- Adaptability. As an open-source method—no high-priced vendors or “black box” statisticians required—NPS can easily be put to work in a wide variety of business settings. Apple uses it in its retail stores, American Express after important servicing calls. Logitech, the computer peripherals manufacturer, uses the system to assess what customers think of every Logitech product. Charles Schwab employed Net Promoter System℠ as it pursued a turnaround.

Customer-related measurements have a long history, and each has its partisans. But we think no other method has as many advantages as the Net Promoter System℠.

NPS and growth

Bain & Company research has established a strong link between organic growth and a company’s Net Promoter Score relative to the relevant competitors in its industry.

To establish the correlation between relative NPS and growth, Bain teams identified the relevant competitors in a business and measured the Net Promoter Scores of each competitor using the same methodology and sampling approach. These relative Net Promoter Scores were then correlated with organic growth measures. In most industries, NPS explained roughly 20% to 60% of the variation in organic growth rates among competitors. On average, an industry’s NPS leader outgrew its competitors by a factor greater than two times.

In other words, a company’s NPS is a good indicator of its future growth. But the relationship is stronger in some industries than in others. It’s strongest when:

- The industry includes a substantial number of players, so customers have a real choice

- Network effects are minimal, so customers can easily switch providers

- The industry is mature, with widespread adoption and use of its products or services

Wherever these conditions do not hold, the relationship may be weak or inconclusive.

Other factors may undermine the relationship as well, at least in the near-term. Companies with deep pockets can open loads of new stores or flood the market with promotions or discounts. Companies with partial monopolies and companies that dominate distribution channels sometimes grow despite weak Net Promoter Scores. And technological breakthroughs can create growth surges. But while loyalty—as indicated by high Net Promoter Scores—isn’t the only factor determining growth, profitable organic growth cannot long be sustained without it.

There’s another important caveat to the connection between high Net Promoter Scores and growth: a high score in and of itself is not the real objective. A high NPS by itself it does not guarantee success. NPS merely measures the quality of a company’s relationships with its current customers, and high-quality relationships are a necessary but insufficient condition for profitable organic growth.

For example, HomeBanc Mortgage Corporation, which was featured in the first edition of the book, had the highest NPS among mortgage banks at the time. But it still fell victim to the mortgage meltdown of 2007, which swept HomeBanc and many of its competitors into bankruptcy. A company must build an army of loyal customers, as HomeBanc did, but it will squander the potential they create if it can’t make effective decisions about risk, pricing, innovation, cost management and everything else necessary for sustainable, profitable growth.

The three types of scores

It’s not unusual for a company to crow about a high Net Promoter Score℠. You may have seen a company—maybe a competitor—issue a press release touting a score as high as 75% or more. Often, the company will compare its Net Promoter Score to scores we published in The Ultimate Question 2.0.

High Net Promoter Scores are certainly better than low ones. They indicate that a company has earned more promoters than detractors. But how do we interpret the scores these companies are reporting? What is a good score? How should we set goals and targets for improvement?

To begin, we should make sure we look at the right sort of Net Promoter Score. Seasoned practitioners of the Net Promoter System gather feedback from their customers in three different ways:

- Competitive benchmark. Finally, leading practitioners of the Net Promoter System sample all target customers for their products or services. They seek feedback not only from their own customers but also from their competitors’ customers. Competitive benchmark Net Promoter Scores provide an objective and fair basis for comparing your company’s feedback to the feedback your competitors earn. Done right, they can provide the basis for goal setting and prioritization at the highest levels of a company.

- Relationship. Net Promoter System companies regularly contact a sample of their own customers, asking them how likely they would be to recommend the company to friends or colleagues, and why. Feedback like this provides an overall assessment of the relationship between company and customer. It provides input to account teams, relationship managers and others so they can make decisions and take actions to improve selling, servicing, product design, pricing or other policies, based on what they learn.

Experience. Net Promoter System practitioners ask for feedback from their own customers after selected experiences, transactions or episodes. For example, they might do so after the purchase of a product or an interaction over the phone. This type of feedback focuses on understanding how customers’ experiences at those moments influenced their overall loyalty so you can figure out ways to improve those experiences.

The competitive benchmark Net Promoter Score is often overlooked or undervalued. Yet it adds an important level of information the other two are likely to miss. It allows a company to learn what respondents think about an entire value proposition, not just their relationship with one particular company. - Experience and relationship Net Promoter Scores fuel continuous improvement. Competitive benchmark scores inform a different set of decisions. They tell a company how it is doing, not just against direct competitors but against every competing alternative in the marketplace. That knowledge helps leaders know where the major threats and opportunities lie. It helps them determine strategic priorities, such as where and how aggressively to invest. The feedback can also provide valuable specifics. For example, you may find that competitor X has suddenly become popular with customers because of a new product or pricing system. Then you can ask whether it makes sense to try emulating or leapfrogging the innovation.

Methodology

Competitive benchmark surveys are a form of traditional market research. Researchers, usually from a third-party firm, ask respondents which companies in a given category they patronize. They ask how likely the respondents would be to recommend each one, and they probe for the reasons. In most cases, they gather data about the respondents’ purchases so they can estimate their economic value as customers. They also ask demographic or psychographic questions to locate the respondent in a particular customer segment. The methodology is almost always double-blind: the respondents don’t know which company is asking the questions, and the customers remain anonymous to the company. As with most market research, the surveys can take 15 or 20 minutes and are designed to provide true comparisons between a company and its competitors. A higher score than the competition, even if it seems low in absolute terms, is a reliable indicator of future growth. The opposite is true as well.

Competitive benchmarking eliminates the responder bias that’s likely to crop up when you survey only your own customers. In your own surveys, people who don’t like doing business with you may decide that it isn’t worth their time to participate. With a third party doing the asking, you’re equally likely to hear from everyone on the love-you/hate-you spectrum.

Competitive benchmarking also eliminates the built-in difficulty of comparing absolute Net Promoter Scores from one geographical region with another. Say your operations in Asia score lower on the Net Promoter zero-to-10 scale than your other operations. A third-party survey will help you establish your performance relative to other companies operating in the same market, eliminating the worry about whether Asian customers are less likely to hand out 9s and 10s than customers in other regions. When you look at your performance relative to competitors in the same market, cultural bias becomes irrelevant. Learn more about key issues in benchmark design.

Employee NPS

Very few companies can achieve or sustain high customer loyalty without a cadre of loyal, engaged employees. Engaged employees are enthusiastic about their work and their company. Their enthusiasm is contagious. It rubs off on other employees, and on customers. Employee promoters power strong business performance because they provide better experiences for customers, approach the job with energy-which enhances productivity-and come up with creative and innovative ideas for product, process and service improvements.

In short, engaged employees play a vital role in creating customer promoters.

eNPS

The eNPS approach, as employee NPS practitioners call it, differs somewhat from customer NPS:

- Sorting employees into Promoters, Passives and Detractors. Most adopters of employee Net Promoter scores, such as Rackspace and Apple, have settled on one central question to determine employee engagement: “On a scale of zero to ten, how likely is it you would recommend this company as a place to work?” However, eNPS is an emerging science. In some cases, Bain & Company has found that a second question can yield an even more accurate gauge of the health of the employee relationship. The second question is typically a variant of this: “How likely would you be to recommend this company’s products or services to a friend or colleague?” (In some settings, this question may need to be modified to include only appropriate friends or colleagues—those who might be qualified to buy such a product or service.)

- Survey length. Employee surveys must be kept confidential to encourage honest feedback. That means follow-up questions must be included in the survey—they can’t be asked by phone as they would in a typical bottom-up Net Promoter customer survey. But eNPS surveys are still much shorter than the typical annual employee survey. Although they can be very useful to the executive team, the primary purpose of these surveys is not merely to help headquarters identify and solve everyone’s problems. Instead, they are designed first and foremost to help teams and team leaders recognize and prioritize issues.

- Frequency. Because eNPS is meant to be part an ongoing operating system that can support coaching, action and continuous improvement, companies often adjust the frequency of the surveys to ensure a steadier stream of input than is provided by traditional annual employee surveys. Some companies survey all their employees every few months. Others survey employees on a staggered or rotating basis to get a continuous stream of new input without putting a heavy survey burden on individual employees. For example, they may send a survey to each employee ninety days after hiring, and again on every anniversary of the hiring date.

- Speed of action. Typical non-NPS employee satisfaction or engagement efforts require data collection and analysis by a third-party firm in a large batch. Data collection and analysis require several weeks or even months, followed by a centrally coordinated process for disseminating the data and recommending actions. In an eNPS system, the surveys are short, and emphasis is placed on sharing (disguised) feedback as quickly and as fully as possible with supervisors and leaders. This supports virtually continuous focus on experimentation and action at the individual, team, function and enterprise levels, with rapid feedback on what’s working and what’s not working.

An employee Net Promoter System makes the people side of the business far more transparent. They support learning and experimentation. Companies can discover which departments represent liabilities and which offer potential best practices. They can see which team leaders are doing the best job and which ones need more coaching. Ultimately, companies can also understand which elements of employee sentiment and engagement most affect customer loyalty advocacy so they can identify ways to improve both.

Be prepared

A note of caution: eNPS scores can be substantially lower than customer scores. Employees often hold their company to even higher standards than do customers. So before you initiate the employee survey process, be ready to process some tough feedback and respond with appropriate action.

NPS in B2B

B2B executives in industries ranging from industrial goods to financial services to healthcare find loyalty to be a powerful lever for them. But earning loyalty in B2B markets poses unique challenges, often involving complicated channel structures, concentrated buyer communities or large accounts with many people influencing the relationship. Defining who the customers really are and how to best engage them requires tailored solutions and a higher level of sophistication.

In B2B markets, even those long regarded as commodities, deriving strategic advantage from loyal customer relationships requires true differentiation. Often that means not just great products at competitive prices, but also dependable delivery, tailored services and a high level of responsiveness and collaboration. The value in most B2B markets has shifted. Among manufacturers, for instance, profit pools have moved downstream to ancillary services, lifetime contracts or provision by the hour—all of which depend on addressing customer needs such as reliability or reduced risk.

Despite the professed importance of customer relationships, it’s getting tougher to maintain them: In a recent survey by Bain & Company of 290 executives in B2B industries throughout 11 countries, 68% of respondents said customers are less loyal than they used to be. B2B companies thus need to go beyond mere satisfaction to earn customers’ enthusiasm and loyalty so that they can improve the business’s economics. Customer loyalty has a big upside on several fronts that combine to accelerate organic growth:

- B2B customers who are “promoters” have an average lifetime value typically three to eight times that of “detractors,” depending on segment and industry. Promoters stay longer with the company, buy more products, usually cost less to serve and are more likely to refer the supplier to colleagues and friends.

- NPS correlates closely with sales growth, expanded share of wallet, sales force productivity, greater market share, greater employee engagement and higher profitability, according to Bain research and client work.

- As a result, B2B loyalty leaders tend to grow four to eight percentage points above their market’s annual growth.

What does it take to delight a B2B customer? Most B2B customers evaluate providers on a combination of several criteria: Do they create economic and strategic value for our business? Do they simplify our daily operations (and my own work life)? Can I trust them? Do I like working with them? An easy, trustworthy partnership in B2B markets can evoke personal feelings every bit as strong as with consumer products and brands.

Turning insights into action at B2B companies

B2B companies who are starting out with Net Promoter should aim to create a system that’s highly tailored to the dynamics of the particular industry. B2B settings often involve several customer constituencies including gatekeepers, business leaders and operational users. Each group has different needs and requires different types of interactions from providers. The design around when, how and with whom to engage will depend on the provider’s channel structure (intermediaries or not), the structure of decision making in the account (external influencers or not), and relevant episodes or moments of truth for the customer.

In construction, jet engines or automotive supply, for example, loyalty depends largely on relationships and project results. A European paint supplier may have only 40 accounts, but each could be a huge automotive manufacturer with hundreds of decision makers and influencers. In this case, most of the supplier’s departments might interact with many individuals at the manufacturing firms they serve. For that reason, mapping its employees to customer contacts could become complex, and the NPS process would require thoughtful choices about whom to ask for feedback and how to communicate back when acting on customers’ comments.

B2B companies that rely on intermediaries to interact directly with customers might consider evaluating ways to improve those relationships. And getting feedback from retailers and end users, not just the intermediaries, can be quite valuable as well.

For an Indian steel company, the insights gleaned from such conversations formed the basis for a new product that is shaping up to be one of its most profitable. By collecting feedback from more than 1,000 end users, retailers and contractors, the company identified an opportunity to target certain farming segments with premium wire fencing. These discussions revealed that one customer segment prized durability because if a wire fence broke, the crops attached to it would fall and rot, while another segment valued ease of installation, so that fencing could be moved to accommodate different crops. This feedback led the company to design a new wire product that is thicker and has a more advanced protective coating for durability.

Insights gleaned from customer feedback will help a firm align investments with its customers’ priorities, size the potential benefits and chart the best course to get there. Many Net Promoter companies find that bringing the voice of the customer into decision-making forces different departments—Manufacturing, R&D, Sales & Marketing and so on—to intensify their collaborations and introduce products that meet customers’ needs.

A simple proposition—think like a customer—can transform performance in even the most complex B2B markets and lead to sustainable competitive advantage. But becoming customer-centered requires substantial changes in ways of working, behaviors and mindsets: from an exclusive focus on product to a wider view that includes customers; from a single department’s key performance indicators to an entire organization looking at one reliable metric; from rigid protocols to teams empowered to help customers. As more companies have discovered, an obsession with customer loyalty pays off with superior growth on the top and bottom lines.

The numbers behind Net Promoter System

If you wanted to motivate your entire organization to take the actions necessary to earn your customers’ loyalty, how would you do it? One way would be to give everyone in the organization a simple, intuitive and immediate indicator of when they had succeeded or failed in that quest. This was what motivated us to develop the Net Promoter Score℠ , a simple, accurate and intuitive way to gauge customer loyalty.

Our goal was to ask one and only one question of customers to estimate their loyalty—a question that was respectful of their time, yet would yield answers that could inspire employees to action. The best single question—across many industries and cultures—turned out to be “How likely are you to recommend [our product or service] to your colleagues, friends or family?”

The answer to that question is the basis for the Net Promoter Score®, which lies at the core of a Net Promoter System. (Learn more about the research behind the score.)

This metric creates a simple scorecard for the organization that has been shown by Bain & Company research, as well as research by a growing number of unaffiliated experts and executives, to explain significant variations in revenue growth rates among companies in head-to-head competition. In Bain & Company research, differences in relative competitive Net Promoter Scores explain anywhere from 10% to 70% of the variation in subsequent revenue growth rates among direct competitors. The NPS leader in a market grows, on average, more than two times faster than its competitors in that market.

The “likelihood-to-recommend”question also allows executives to sort customers into one of three groups: promoters, passives, and detractors. These simple, easy-to-understand groups behave differently, with promoters generally staying longer, buying more and telling their friends, and the other groups doing less of this. While on average, the lifetime value differences between detractors and promoters tend to run from 3X-8X, Bain & Company recommends that individual companies develop their own analysis of the customer value of each of these groups, since customers in different businesses, different competitive environments and different geographic markets differ in the extent to which their behaviors vary.

For more on these differences in individual customer value, see the following resources:

- Loyalty economics (netpromotersystem.com)

- “Likelihood to recommend” tops customer experience measures (The Temkin Group)

- The Power Behind a Single Number (Satmetrix)

While an individual customer’s Net Promoter Score, also known as a “bottom-up score,” predicts future individual value, a different type of score—relative Net Promoter Score, or “top-down score”—explains differences in company growth among competitors. Though sometimes confused, these two types of scores are collected and used differently—to learn more, see Bottom-up and top-down scores. For more about how relative Net Promoter Scores explain differences among competitors, see the following resources:

- Customer Advocacy Drives UK Business Growth (London School of Economics)

- Net Promoter Scores Australia 2006 (Mark Ritson, Melbourne School of Business)

- Customer Loyalty in Retail Banking (Bain & Company)

Companies using NPS

Net Promoter System℠ helps companies in all industries build customer loyalty and achieve growth. The following is a partial list, by industry, of companies that have stated in the press, financial filings or other public outlets that they use Net Promoter® score to track customer loyalty.

Air TransportationDelta Air Lines Industrial Goods & ServicesABB, Ltd Consumer ProductsAcantia Health & Beauty HealthcareAscension Health Service providers/B2B/Suppliers/Public sector800GotJunk TelecomAsurion | Retail24 Hour Fitness Financial ServicesAIA TechnologyAMICAS MediaAvid Technology |